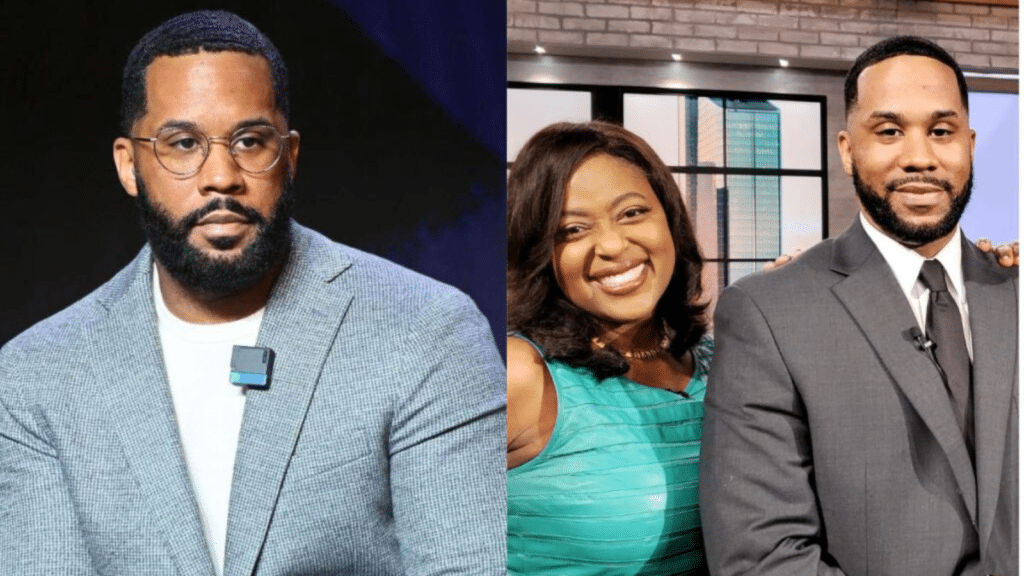

Ian Dunlap Age is a key topic when discussing his remarkable rise in the world of investing and financial education. Born on August 2, 1982, in East Chicago, Indiana, Ian’s journey from a young investor to a master investor and financial educator has inspired countless individuals. His investment strategies emphasize long-term investing, high-quality companies like Tesla, Apple, and Amazon, and managing asymmetric risk.

Through platforms like Red Panda Academy, Earn Your Leisure, and Market Mondays, Ian shares invaluable insights into creating generational wealth. His focus on diversification and risk-reward analysis has made him a trusted figure in the financial community.

Early Life and Background: The Roots of Ian Dunlap’s Success

Ian Dunlap was born on August 2, 1982, in East Chicago, Indiana. Growing up in a working-class family, Ian faced the same challenges many people face when it comes to wealth creation—lack of resources, limited exposure to financial education, and uncertainty about how to achieve financial success. However, he didn’t let these barriers define his future.

Ian’s formative years were shaped by his family, especially his parents, Charles Dunlap and Patricia Dunlap. His father instilled in him a strong work ethic, and his mother played a crucial role in nurturing his curiosity. This foundation created the mindset that would propel Ian into a successful career.

Ian Dunlap’s Educational Journey

Education has been a cornerstone of Ian’s success. Although he didn’t attend an Ivy League school straight out of high school, his desire for knowledge led him to Harvard Business School, where he completed the Owner/President Management Program.

This prestigious program played a critical role in shaping his investment philosophy and understanding of business management. Ian’s business education didn’t just stop at formal schooling. His commitment to self-education in investing helped him refine his strategies for long-term wealth-building and financial literacy.

Through books, mentorships, and continuous research, Ian mastered the concepts of risk management, diversification, and investment strategies, all of which are central to his financial success.

Key Facts About Ian Dunlap

| Attribute | Details |

| Full Name | Ian Dunlap |

| Date of Birth | August 2, 1982 |

| Age | 42 years old (as of 2025) |

| Place of Birth | East Chicago, Indiana |

| Net Worth | Estimated at $40 million |

| Education | Harvard Business School, Owner/President Management Program |

| Key Investments | Amazon, Tesla, Apple |

| Occupation | Investor, Financial Educator, Mentor |

| Known For | Founder of Red Panda Academy, Host of Market Mondays, Earn Your Leisure |

| Social Media Platforms | Instagram, Facebook, X (formerly Twitter), YouTube |

| Investment Philosophy | Long-term investing, Asymmetric risk, High-quality companies |

| Family | Son of Charles and Patricia Dunlap |

| Influences | Warren Buffett |

| Key Projects | Red Panda Academy, Market Mondays, Earn Your Leisure |

How Ian Dunlap’s Family Shaped His Success

Ian’s family had a profound influence on his mindset and his path to financial success. His father, Charles Dunlap, was an entrepreneur, while his mother, Patricia Dunlap, was the nurturing force that encouraged his love for learning.

Ian credits his parents for teaching him the importance of discipline, hard work, and perseverance. They were not wealthy in terms of money, but they provided him with something far more valuable: the tools for self-education and a belief that financial freedom was attainable.

This early exposure to the concept of wealth-building through knowledge laid the foundation for Ian’s future achievements. His success was not just the result of trading skills but also a mindset shaped by his upbringing.

Ian Dunlap’s Rise in the Investment World

Ian Dunlap’s path to becoming a master investor began after years of studying the stock market. He spent countless hours analyzing charts, reading about market volatility, and understanding how successful investors like Warren Buffett achieved long-term financial success.

Ian’s breakthrough came when he realized that the real key to wealth was long-term investing. While many traders focus on short-term gains, Ian’s strategy was focused on building wealth through high-quality investments in companies like Amazon, Tesla, and Apple.

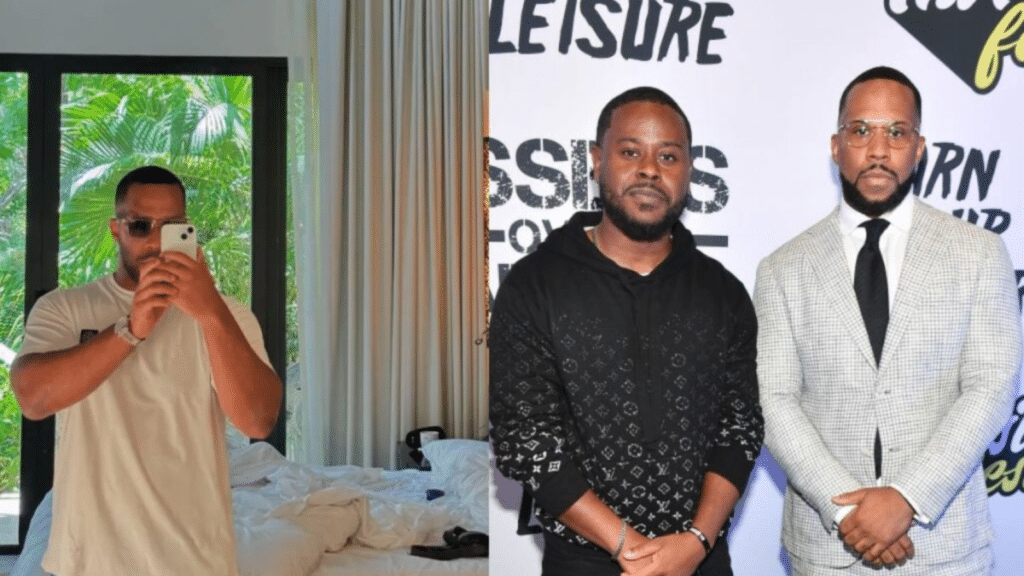

As his expertise grew, he began mentoring others. His role as a financial educator became more prominent, especially with his involvement in Earn Your Leisure and Market Mondays, two platforms that focus on financial literacy and investment education.

Ian Dunlap’s Unique Investment Strategies

Ian Dunlap is known for his unique investment strategies, which emphasize asymmetric risk and long-term growth. Rather than following the crowd, Ian often chooses to invest in high-quality companies that he believes will continue to grow over time.

One of his key principles is the concept of asymmetric risk—the idea that in certain investments, the potential upside is far greater than the downside. He also advocates for diversification, ensuring that an investor’s portfolio is spread across various industries and asset classes to manage risk effectively.

Key Strategies:

- Long-Term Investing: Ian favors investments that will appreciate over a long period, rather than looking for quick, speculative gains.

- Asymmetric Risk: Ian seeks investments where the potential reward far outweighs the risk involved.

- Diversification: Spreading investments across various sectors and asset classes to protect against market volatility.

“Give First”: Ian Dunlap’s Key to Success

One of the most compelling aspects of Ian’s philosophy is his “Give First” mindset. Ian believes that in order to achieve true success, you must first be willing to give. This principle applies not just in business but in investment mentorship, financial education, and philanthropy.

By giving value first—whether through Red Panda Academy, his mentorship programs, or his social media platforms—Ian has built a loyal community that trusts his advice. This approach has led to a greater influence in the world of financial education.

Ian Dunlap’s Long-Term Wealth Strategy

Ian’s long-term wealth strategy centers around creating generational wealth. This isn’t about short-term gains or flipping stocks. Instead, Ian advocates for patient investing, allowing time to work in your favor and compounding growth to drive financial success.

He focuses on investing in high-quality companies, like Amazon, Tesla, and Apple, which have proven track records of sustainable growth. Ian’s strategy involves taking calculated risks, minimizing losses, and holding onto investments for the long haul.

Long-Term Wealth Principles:

- Invest in high-quality companies with strong growth potential.

- Focus on market volatility and leverage it for buying opportunities.

- Create a diversified portfolio that spreads risk across different sectors.

Ian Dunlap’s Social Media Influence

As a leading voice in financial education, Ian has successfully leveraged social media platforms like Instagram, Facebook, X (formerly Twitter), and YouTube to engage with millions of followers. His platforms provide a wealth of financial education, from stock market tips to strategies for building wealth and achieving financial independence.

Through his role as the host of Market Mondays and his involvement in Earn Your Leisure, Ian has become an authority in the world of investment education. His ability to connect with audiences and simplify complex investment concepts has earned him the title of a trusted financial educator.

Ian Dunlap’s Net Worth and Sources of Wealth

As of 2025, Ian Dunlap’s estimated net worth is around $40 million. His wealth comes from a variety of sources, including his successful investments, business ventures, and educational initiatives.

Major Income Sources:

- Investments: Ian’s investments in companies like Amazon, Tesla, and Apple have been key contributors to his wealth.

- Red Panda Academy: The educational platform he founded provides financial education to thousands of students.

- Earn Your Leisure & Market Mondays: Ian generates income through his involvement in these platforms, where he shares financial tips and investment strategies.

- Social Media & Sponsorships: His influence on social media also opens doors for brand partnerships and sponsorships.

Key Lessons from Ian Dunlap

Ian Dunlap’s career and personal philosophy offer a wealth of valuable lessons for anyone looking to improve their financial situation. Here are some of the most important takeaways from his journey:

1. Focus on Long-Term Gains

Ian’s long-term investing strategy has proven time and again that slow, steady growth beats fast, risky gains. Be patient and let your investments compound over time.

2. Understand Risk to Reward

Ian emphasizes the importance of understanding the risk-reward ratio when making investment decisions. Asymmetric risk is about seeking opportunities where the potential rewards are much greater than the risks.

3. Invest in High-Quality Companies

The stock market can be unpredictable, but investing in high-quality companies like Apple, Tesla, and Amazon offers stability and potential growth.

4. Discipline is Key

Successful investing requires discipline. Stick to your strategy, avoid emotional decisions, and remain consistent in your approach.

5. Master the Stock Market Mindset

A strong stock market mindset involves managing emotions and staying focused on your long-term goals, rather than getting swayed by short-term market fluctuations.

FAQs

Is the Red Panda Still Alive?

Yes, red pandas are still alive. They are a vulnerable species, with efforts being made to protect their natural habitats and increase their population.

Who is the CEO of Red Panda Academy?

The CEO of Red Panda Academy is Ian Dunlap. He founded the platform to provide financial education and empower individuals with wealth-building strategies.

How Many Pandas Are Left in 2025?

As of 2025, there are approximately 2,500 red pandas remaining in the wild, making them a vulnerable species. Conservation efforts are ongoing to protect their population.

Is the Red Panda the Cutest Animal?

Many consider the red panda to be one of the cutest animals due to its small size, fluffy tail, and adorable face. Its playful nature only adds to its charm.

How Old is a 1 Year Old Panda in Human Years?

A 1-year-old panda is roughly equivalent to a 6-year-old human in terms of development, as pandas mature quickly in their early years.

Conclusion

Ian Dunlap has built an impressive career as a financial educator, investor, and mentor. His story is one of resilience, continuous learning, and an unwavering commitment to financial literacy. From his Harvard Business School education to his influential role on platforms like Earn Your Leisure and Market Mondays, Ian has become a beacon of financial wisdom for aspiring investors.

With an estimated net worth of $40 million, Ian continues to be a leading figure in the world of financial education. His principles of long-term investing, diversification, and high-quality investments have already inspired thousands, and his future looks bright as he continues to empower others to achieve generational wealth.

Whether you’re just starting your investing journey or looking to refine your strategies, Ian Dunlap’s approach provides valuable insights for achieving financial success and independence.

“Related Blogs “

Stacey Bendet Net Worth: A Closer Look at the Alice + Olivia CEO’s Wealth

Andre Hakkak Net Worth Revealed: How the CEO Built His Fortune

Steve Spitz Net Worth 2025: You Need to Know About Steve Spitz

Who Is Caressa Suzzette Madden? The Untold Story..

Kevin Bray is an experienced blogger and the creative force behind Celeb Lift. With a passion for entertainment and celebrity news, he brings insightful and engaging content to his readers. Kevin’s in-depth knowledge and years of writing experience make him a trusted voice in the world of celebrity culture, delivering up-to-date stories and trends to keep readers informed and entertained.